Senator Cynthia Lummis of Wyoming has proposed audacious legislation that could reshape the United States’ approach to cryptocurrency and national debt management. The senator’s plan, unveiled at the Bitcoin Conference in Nashville, calls for the establishment of a “strategic bitcoin reserve” aimed at reducing the country’s national debt through the acquisition of 1 million bitcoin (BTC) over a five-year period.

This bold initiative, likened by Senator Lummis to the historic Louisiana Purchase, represents a significant shift in how the U.S. government might leverage digital assets to address economic challenges. The proposal comes at a time when cryptocurrencies, particularly Bitcoin, are gaining increased attention from both investors and policymakers worldwide.

Former President Trump Endorses Bitcoin Reserve Concept

In a surprising turn of events, former President Donald Trump has thrown his support behind Senator Cynthia Lummis’ proposal. Trump’s endorsement of the idea of a bitcoin reserve marks a significant departure from his previous stance on cryptocurrencies and could potentially influence the Republican party’s approach to digital assets.

The former president’s support adds considerable weight to the proposal, potentially increasing its chances of gaining traction in Congress. This unexpected alliance between Senator Lummis and Trump highlights the evolving nature of cryptocurrency policy and its growing importance in mainstream political discourse.

Economic Implications and Long-Term Strategy of Senator Cynthia Lummis’ Plan

Senator Cynthia Lummis’ plan outlines a long-term strategy for the proposed bitcoin reserve. The legislation stipulates that the acquired bitcoin would be held for a minimum of 20 years, demonstrating a commitment to a sustained investment approach. At current market prices, the proposed 1 million bitcoin would be valued at approximately $68 billion.

The economic implications of such a move are significant and multifaceted. Proponents argue that this strategy could provide a hedge against inflation and potentially yield substantial returns over time, given Bitcoin’s historical price appreciation. Critics, however, may raise concerns about the volatility of cryptocurrency markets and the wisdom of tying national debt reduction strategies to a relatively new and often unpredictable asset class.

Furthermore, the implementation of this plan could have far-reaching effects on the global cryptocurrency market, potentially driving up demand and prices for Bitcoin. It may also prompt other nations to consider similar strategies, potentially reshaping international economic dynamics in the digital age.

Senator Cynthia Lummis Counters Biden Administration’s Bitcoin Mining Tax Proposal

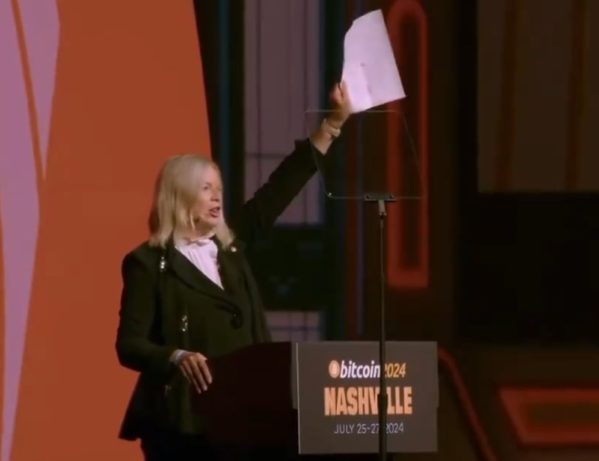

Senator Cynthia Lummis delivered a compelling speech directly following former President Donald Trump’s keynote address, where he vowed to position the United States as the global hub for cryptocurrencies if re-elected. Lummis, a prominent advocate for digital currencies, seized the moment to underscore her opposition to President Joe Biden’s proposed 30% excise tax on energy consumed by Bitcoin miners.

In her address, Lummis referenced her recently published report titled “Powering Down Progress: Why A Bitcoin Mining Tax Hurts America,” which argues vehemently against the Biden administration’s tax initiative. The report, released on July 23, meticulously outlines the integral role of Bitcoin mining infrastructure in bolstering the stability and resilience of the national energy grid. According to Lummis, imposing such a tax could stymie innovation and economic growth in the burgeoning cryptocurrency sector, undermining America’s potential to lead in this transformative technology.

Senator Cynthia Lummis’ stance aligns with sentiments echoed by industry experts and cryptocurrency enthusiasts who view Bitcoin mining as a vital component of energy innovation and economic development. Her speech resonated deeply within the crypto community, sparking further debates on the future regulatory landscape for digital assets in the United States. As the election season intensifies, Lummis’s advocacy for a supportive regulatory environment for cryptocurrencies is poised to remain a pivotal issue, influencing voter sentiments and policy discussions alike.

Crypto Industry Reactions and Potential Impact

Senator Cynthia Lummis, known for her pro-cryptocurrency stance, received an enthusiastic response from attendees at the Bitcoin 2024 conference. Her proposal has sparked discussions within the crypto community about the potential ramifications of such a significant government investment in Bitcoin.

If passed, the Bitcoin Reserve Bill could have far-reaching effects on both the cryptocurrency market and the broader financial landscape. Proponents argue that it would legitimize Bitcoin as a store of value and potentially stabilize its price. Critics, however, raise concerns about the volatility of cryptocurrency markets and the risks associated with such a large-scale government investment in a relatively new asset class. As the bill moves through the legislative process, it is likely to face scrutiny from both supporters and skeptics, potentially reshaping the relationship between government finance and digital currencies.