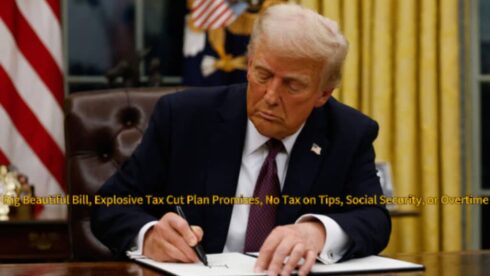

President Donald Trump has once again electrified his political base by announcing a tax reform initiative he calls the “one big beautiful bill.” Speaking during a rally in Michigan, Trump declared that the bill will include “the largest tax cuts in American history,” with a special focus on working-class Americans and retirees. Key measures include eliminating taxes on tips, Social Security, and overtime pay, signaling a shift toward a more populist fiscal policy.

Donald Trump stressed the urgency of pushing the reforms through Congress in the coming weeks, painting them as necessary relief in an era of inflation and economic strain. “People who work hard should keep their money,” he stated. The message was clear: his administration aims to reduce the tax burden on everyday Americans while simplifying the tax code for long-term sustainability.

Donald Trump’s Promise: No Tax on Tips, Social Security, or Overtime

Central to Donald Trump’s tax plan is the elimination of taxes on three major income sources for many Americans: gratuities, retirement benefits, and overtime earnings. He described this move as a way to “honor the sweat and service” of hardworking citizens, particularly those in the service industry and senior population.

Critics argue that while these tax breaks are popular with voters, they may lead to budget shortfalls unless paired with spending cuts or new revenue streams. Trump, however, remains confident that increased economic activity will compensate for lost tax revenue. “The money will flow back in—tenfold,” he claimed, referencing supply-side economic theories embraced during his first administration.

Economic Analysts Warn of Debt and Inflation Consequences

While the proposal has been welcomed by many wage earners, economists are raising red flags. Reputable institutions such as the Brookings Institution and the Committee for a Responsible Federal Budget warn that such sweeping tax cuts could balloon the national deficit and accelerate inflationary trends already burdening consumers.

These experts argue that eliminating taxes on significant income categories without equivalent offsets risks increasing government borrowing, which could spike interest rates and devalue the dollar. Trump brushed off these concerns as “elite academic noise,” claiming the real economy thrives when Washington takes its “boot off the necks of workers and entrepreneurs.”

Donald Trump Reclaims Populist Mantle with Pro-Worker Tax Pitch

Unlike traditional Republican tax platforms that emphasize corporate benefits, Trump’s current tax plan puts workers at the forefront, allowing him to reclaim the populist mantle that fueled his earlier campaigns. “The people who built this country—waiters, welders, nurses, and truckers—deserve to keep their full paycheck,” Trump told an enthusiastic crowd.

This rhetorical pivot is being interpreted as a calculated political strategy to solidify support among blue-collar voters, many of whom feel left behind by both parties. By championing specific relief for gratuities and overtime—sectors often ignored in broader fiscal debates—Trump aims to forge a unique and emotionally resonant economic brand.

Wall Street Divided Over Donald Trump’s Tax Reform Momentum

Trump’s announcement rattled financial markets, with Wall Street offering a mixed response. While some sectors, like retail and hospitality, welcomed the plan for its potential to boost consumer spending, bond and investment firms expressed concern about future interest rates and public debt stability. The Dow dipped slightly, while tech stocks showed moderate gains amid tax uncertainty.

Major financial institutions such as Goldman Sachs and Wells Fargo released cautious investor briefings, urging clients to prepare for “policy-driven volatility” over the next fiscal quarter. Trump, however, was unfazed, telling supporters, “The market knows I deliver results—and this is just the beginning.”

Legislative Challenges Loom as Trump Seeks Fast Passage

Despite Trump’s confidence, the tax bill still faces significant legislative hurdles. While some Republican lawmakers have rallied behind the proposal, others are demanding detailed fiscal analysis before committing support. Without full Republican alignment, the bill’s passage could stall or be diluted in committee.

Trump responded to critics within his own party with characteristic bluntness: “We don’t need more spreadsheets—we need action.” He has hinted at leveraging public pressure, mobilizing voters to contact their representatives and demand fast-tracking of the bill. If passed, the legislation would mark one of the most dramatic shifts in U.S. tax policy in decades.