“Big Beautiful Bill” for the Wealthy

WASHINGTON, D.C. — Representative Tom Suozzi has voiced strong opposition to the latest Republican-backed tax bill, warning that it fails to live up to former President Donald Trump’s widely touted tax promises. Despite campaign rhetoric aimed at working-class Americans, Suozzi argues that the bill—dubbed the “Big Beautiful Bill” by its supporters—falls short of delivering meaningful relief and could instead deepen inequality.

“The American people were promised no taxes on tips, overtime, and Social Security,” Suozzi said. “What this bill offers are temporary loopholes, not permanent solutions—and it does more for the wealthy than for working families.”

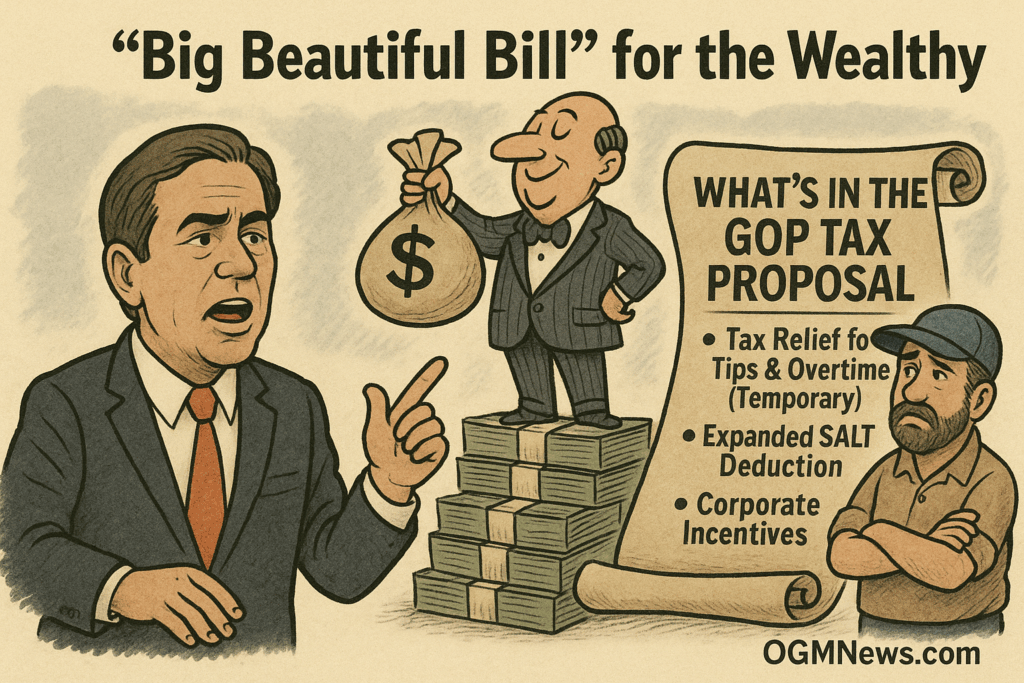

“Big Beautiful Bill” for the Wealthy: What’s in the GOP Tax Proposal?

“Big Beautiful Bill” for the Wealthy

The bill proposes several extensions and modifications to the 2017 Tax Cuts and Jobs Act. Among the headline features:

- Tax Relief Provisions: The legislation temporarily eliminates federal income taxes on tips and overtime pay—but only through 2028. It also boosts standard deductions for seniors, though it does not eliminate federal taxation on Social Security benefits.

- SALT Deduction Cap Expansion: The proposal raises the state and local tax (SALT) deduction cap from $10,000 to $30,000—but only for those earning under $400,000 annually. Critics say this disproportionately benefits higher earners in wealthier states.

- Corporate Incentives: While corporate tax rates remain unchanged, new deductions are introduced, including for interest paid on U.S.-assembled vehicle loans.

Despite these provisions, Suozzi and other Democrats argue that the bill’s benefits are front-loaded for wealthier individuals and corporations while only marginally helping middle-class taxpayers.

Critics Say Social Security and Seniors Are Left Behind in the “Big Beautiful Bill“

“Big Beautiful Bill” for the Wealthy

One of the key issues raised by Rep. Suozzi and fiscal analysts is the bill’s treatment of Social Security. While older Americans are offered higher deductions, there is no clear move to eliminate federal taxes on Social Security income—an issue Trump repeatedly vowed to address.

This omission has implications far beyond tax season. Analysts warn that reducing or removing Social Security taxation without offsetting revenue could threaten the solvency of the Social Security Trust Fund. Already projected to face shortfalls by 2033, the fund could be further destabilized by tax changes that are not paired with long-term fiscal planning.

“The omission of real Social Security relief is more than a broken promise—it’s a ticking time bomb for retirement security,” said one policy analyst at the Center on Budget and Policy Priorities.

Who Really Benefits from the “Big Beautiful Bill”? Wealth vs. Working Class

“Big Beautiful Bill” for the Wealthy

Despite Republican messaging about aiding working Americans, the bill’s biggest fiscal benefits appear tilted toward the wealthy. The expanded SALT deduction cap overwhelmingly benefits homeowners in affluent areas—many of whom already enjoy other tax advantages. Meanwhile, renters and low-wage workers, especially those without tipped income, see minimal direct relief.

Critics also highlight the bill’s continuation of 2017-era corporate tax cuts and new incentives that appear to favor specific industries. These measures, according to Suozzi, reflect a familiar pattern: “This is trickle-down economics dressed in populist clothing.”

Furthermore, the Congressional Budget Office projects that the bill could add up to $4.6 trillion to the national deficit over the next decade—raising alarms about future spending cuts or tax increases.

The Politics Behind the Promises

Suozzi and other lawmakers suggest that the bill’s misleading language and selective relief measures are part of a broader political strategy. While the GOP emphasizes “tax relief for workers,” key components of the legislation rely on temporary provisions, IRS discretion, or sunset clauses—leaving real impacts uncertain.

“There’s a deliberate mismatch between the soundbites and the substance,” Suozzi said. “This isn’t just fuzzy math—it’s fuzzy morality.”

Analysts cite several reasons why Republican leaders may continue to promote such narratives:

- Appealing campaign messaging that obscures complexity.

- Protecting wealthy donors through favorable tax structures.

- Reinforcing ideological beliefs in “trickle-down” economics.

- Avoiding political fallout by not admitting the bill’s shortcomings.

A Bill with Lofty Promises, Uncertain Delivery

While the “Big Beautiful Bill” includes popular provisions like tax relief on tips and an expanded SALT cap, it does not fulfill former President Trump’s sweeping promises to eliminate taxes on overtime and Social Security. With concerns about fairness, fiscal sustainability, and transparency mounting, the bill is likely to face intense scrutiny as it moves through Congress.

As Suozzi warns, “It’s not enough to pass a tax bill with a nice name. We need policies that actually uplift working families—not just headlines that pretend to.”