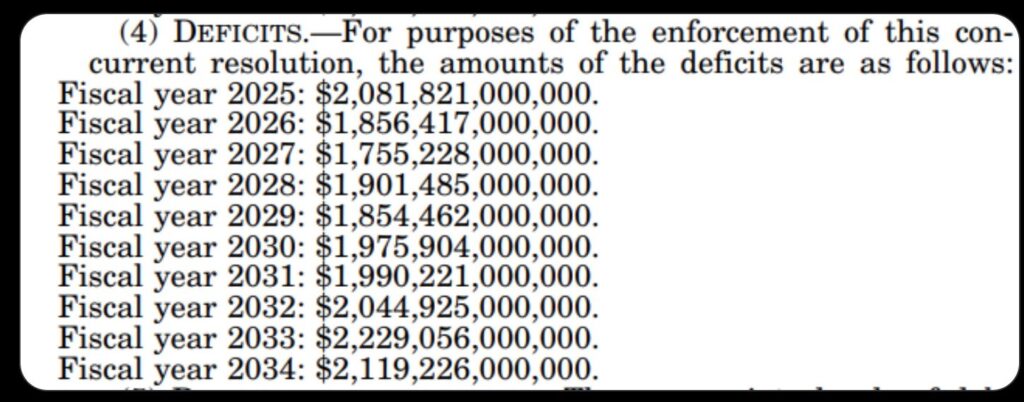

Party of Fiscal Conservatives | The U.S. national debt is set to soar by nearly $19 trillion over the next decade, following a controversial fiscal policy shift that includes massive tax cuts and deep reductions in social welfare programs. A budget resolution narrowly passed by the House of Representatives proposes $4.5 trillion in tax cuts alongside $2 trillion in spending reductions. Despite these cuts, projections suggest the national deficit will still grow by approximately $2.8 trillion by 2034.

According to the Congressional Budget Office (CBO), this expansion will push federal debt to 118% of GDP by 2035. While supporters of the plan argue that tax cuts will spur economic growth, critics warn that slashing essential public assistance programs could have devastating effects on millions of vulnerable Americans.

Party of Fiscal Conservatives: Huge Debt Despite Drastic Cuts to Medicaid and SNAP

A central aspect of the budget resolution includes $880 billion in cuts to Medicaid and $230 billion in reductions to the Supplemental Nutrition Assistance Program (SNAP). Medicaid provides healthcare for low-income individuals, and these cuts could result in millions losing coverage. Similarly, SNAP, which assists over 9 million Americans each month, faces significant reductions that could lead to increased food insecurity.

Party of Fiscal Conservatives | Opponents argue that these cuts disproportionately target children, seniors, and struggling families. Policy analysts warn that the financial burden could shift to states and local governments, potentially creating a healthcare crisis and worsening poverty levels nationwide.

Debate Over Tax Cuts for Corporations and the Wealthy

Party of Fiscal Conservatives | The budget resolution follows a familiar pattern seen in previous fiscal policies—tax breaks that primarily benefit corporations and high earners, offset by reductions in public assistance programs. Supporters claim that cutting government spending is essential for long-term economic stability and that tax cuts will drive investment and job creation.

However, critics argue that these measures widen the wealth gap, benefiting the affluent while burdening middle- and low-income families. The distribution of tax benefits is expected to disproportionately favor large businesses and top income brackets, further fueling concerns about economic inequality.

Party of Fiscal Conservatives: Concerns Among Republican Lawmakers

Despite passing through the House, the budget resolution has sparked debate within the Republican Party. Representative Tony Gonzales has expressed concern over the impact on low-income families, emphasizing the need to maintain a safety net for hardworking Americans. Other GOP members have cautioned against the political risks of cutting essential social programs while adding to the national debt.

As the resolution moves to the Senate, divisions within the party could influence potential amendments or revisions. With a slim majority, Republicans face the challenge of balancing fiscal conservatism with the need to address growing public backlash.

Future Legislative Uncertainty

Party of Fiscal Conservatives | If enacted, these fiscal changes could be revisited by future administrations and Congresses. The legislative process allows for amendments, repeals, or new tax and spending policies, but such changes depend on political dynamics, economic conditions, and public sentiment.

Notably, provisions from the 2017 Tax Cuts and Jobs Act (TCJA) are set to expire in 2025, providing an opportunity for lawmakers to reassess the nation’s fiscal strategy. However, relying on future legislative changes introduces uncertainty, particularly in a politically polarized climate.

Party of Fiscal Conservatives: The Broader Implications

The proposed fiscal policy raises pressing questions about economic priorities and social equity. While supporters argue that reducing government spending is essential for economic stability, critics emphasize the potential harm to low-income families, healthcare access, and food security. Party of Fiscal Conservatives | As debates continue, the broader implications remain clear: fiscal decisions made today will shape the economic and social landscape for years to come. The challenge lies in balancing budgetary concerns with the fundamental needs of millions of Americans.