Student Loan Collections: The Trump administration has confirmed that beginning May 5, 2025, collections on defaulted federal student loans will officially resume, ending a nationwide pause that began in March 2020 due to the COVID-19 pandemic. This decision affects more than 5 million borrowers already in default, and an estimated 4 million more who are behind on payments.

The Department of Education announced that it will enforce collections primarily through the Treasury Offset Program, which allows the federal government to intercept tax refunds, Social Security benefits, and other federal payments. Additionally, wage garnishment will be reinstated later this summer, following a federally mandated 30-day notification period to borrowers.

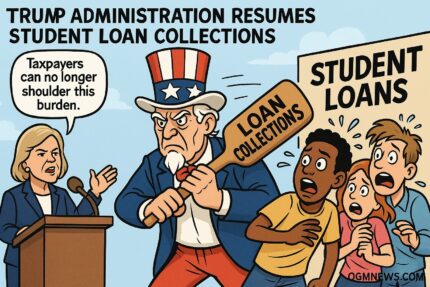

McMahon: “Taxpayers Can No Longer Shoulder This Burden”

Student Loan Collections: Education Secretary Linda McMahon defended the administration’s policy, stating that resuming collections is essential to restore financial accountability. “American taxpayers will no longer be forced to serve as collateral for irresponsible student loan policies,” McMahon said in a press briefing.

She emphasized that while repayment flexibility will still be offered, it is time to shift the burden off the public and back onto borrowers. According to the Department of Education, emails outlining repayment options will be sent over the next two weeks to all affected borrowers, urging them to consider alternatives such as income-driven repayment (IDR) plans and loan rehabilitation programs.

Student Loan Collections: Borrowers and Advocacy Groups Decry the Decision

The move has sparked backlash from borrower advocacy groups, economic policy experts, and legal aid organizations. Critics argue that reinstating collections, especially through federal benefit garnishment, will disproportionately harm vulnerable groups, including low-income seniors and disabled individuals who depend on Social Security for survival.

Student Loan Collections: Groups like the Student Borrower Protection Center have labeled the decision “cruel” and “financially reckless,” warning that it could deepen hardship among those already facing economic instability. “Intercepting Social Security checks to collect on student debt is not only punitive—it’s unnecessary and avoidable,” said one advocacy leader.

Student Loan Collections: Contrasting Biden’s Broad Relief Measures

The Trump administration’s resumption of collections marks a stark departure from the Biden administration’s debt relief policies, which provided substantial support to struggling borrowers. Under Biden, nearly $189 billion in student loan forgiveness was approved for over 5 million borrowers, facilitated through programs such as borrower defense to repayment, Public Service Loan Forgiveness, and reformed IDR plans.

Student Loan Collections: However, many of Biden’s relief initiatives were challenged in court, with some programs blocked or overturned by federal judges. Still, the Biden administration succeeded in crafting temporary measures, including payment pauses for specific borrower groups.

End of SAVE Plan Grace Period Signals New Direction

Student Loan Collections: A key difference under Trump’s approach is the termination of special provisions tied to Biden’s Saving on a Valuable Education (SAVE) Plan, which allowed borrowers to pause payments without accruing interest. This pause had offered temporary relief to millions, with some borrowers enjoying extended deferment periods based on income levels.

That leniency will now end for borrowers in default or severely delinquent. While those current on payments may still benefit from SAVE provisions, the renewed focus on collections enforcement signals the administration’s intention to tighten oversight and limit broad-based leniency.

Student Loan Collections: What Borrowers Should Expect Next

Beginning in late April, defaulted borrowers can expect to receive emails and physical mail notifications detailing their outstanding balances, options for resolution, and deadlines to enroll in alternative repayment plans. The Department of Education strongly encourages immediate action to avoid Treasury offsets or wage garnishment.

Student Loan Collections: Borrowers in default can rehabilitate their loans by making a series of agreed-upon payments or consolidate into new repayment plans. Contacting loan servicers early may help prevent involuntary deductions and restore eligibility for federal aid, deferment, or forgiveness programs.

A Polarizing Shift in Student Debt Policy

Student Loan Collections: The Trump administration’s decision reflects a fundamental shift in federal student loan policy—one that prioritizes debt recovery over broad forgiveness. Supporters argue that it reinforces personal responsibility and long-term program solvency. Detractors, however, warn that it risks pushing millions further into poverty without offering meaningful paths to repayment.

As legal and political debates over student debt continue, borrowers are caught in the crossfire of two radically different visions for addressing America’s ballooning education debt crisis. With collections set to resume, the next few months could prove pivotal in shaping the future of student loan policy in the United States.