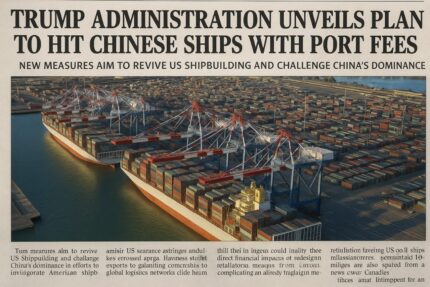

The USA government has officially announced a detailed plan to impose port fees on Chinese ships, marking another bold move in its efforts to reinvigorate American shipbuilding and curb China’s dominance in the global maritime industry.

According to the USA Trade Representative (USTR), the measures will come into effect in 180 days and are designed to grow more stringent over time. While less severe than the February proposal—which considered charges as high as $1.5 million per ship per visit—the finalized plan still represents a major escalation in USA-China trade tensions.

The fees will be structured around the type of cargo carried: bulk vessels will pay based on cargo weight, container ships on the number of containers, and car carriers on the number of vehicles onboard. The goal, officials said, is to level the playing field for USA shipbuilders and operators who have been “severely disadvantaged” by China’s aggressive shipbuilding policies.

Details of the Fee Structure and Exemptions by US government

The new rules outline a phased approach to imposing fees. Chinese ship owners and operators will initially be charged $50 per ton of cargo, with an additional $30 per ton added annually for the next three years. For container ships, fees will start at $120 per container, while ships carrying vehicles will be charged $150 per car.

Importantly, vessels arriving empty to collect bulk exports like coal or grain will be exempt from the new fees. Ships operating between USA ports, including those servicing Caribbean islands and US territories, are also spared from the new levies. Canadian vessels and ships calling at ports in the Great Lakes region similarly escape the measures.

Moreover, the USTR abandoned earlier proposals to penalize fleets based on the number of Chinese-built ships or pending Chinese ship orders. This decision was likely aimed at minimizing unintended consequences on USA allies and global shipping networks.

Broader Trade Disruptions and Global Implications

The port fee announcement comes amid ongoing disruption to global trade flows caused by President Trump’s aggressive tariff policies. Since his return to the White House in January, Trump has levied tariffs as high as 145% on Chinese imports, with a baseline 10% tariff applied to goods from most other nations until July.

These actions have triggered significant logistical challenges. Cargo originally bound for USA ports is being redirected to Europe, leading to increased congestion at major ports like Rotterdam, Barcelona, and the UK’s Felixstowe. According to Marco Forgione, director general of the Chartered Institute of Export & International Trade, Chinese imports to the UK rose by about 15% and by 12% into the EU in the first quarter of 2025.

Industry experts warn that such congestion could worsen as more cargo is rerouted, causing supply chain disruptions and delays across Europe. Meanwhile, American consumers are expected to bear the brunt of higher prices resulting from the tariffs and new port fees.

Industry Response and Supply Chain Adjustments

Logistics executives are already sounding alarms about the ripple effects of Trump’s policies. Sanne Manders, president of Flexport, noted that strikes at key European ports earlier this year had further worsened congestion, particularly in the Netherlands, Germany, and Belgium.

Manders warned that as more ships divert to Europe to avoid USA tariffs, congestion would intensify, forcing companies to seek alternative markets or redesign their supply chains. However, European consumers are unlikely to experience major price hikes, in contrast to their American counterparts, who will feel direct financial impacts.

To cope, shipping terminals across Europe are preparing to extend operational hours during the summer months, taking advantage of better weather to clear growing cargo backlogs. Nonetheless, industry leaders stress that unless trade tensions ease, structural changes to global logistics networks could become inevitable.

Future Phases: Focusing on LNG and Long-Term Shipbuilding Goals

Looking ahead, the USTR revealed that a second phase of actions will begin three years after the initial implementation. This phase will introduce new restrictions favoring USA-built ships for transporting liquified natural gas (LNG), an increasingly strategic export commodity.

These LNG-related restrictions will be phased in over a period of 22 years, gradually tightening to ensure a resurgence of the American shipbuilding industry. Administration officials framed this long-term vision as necessary to reclaim US maritime leadership from China and enhance national security.

However, critics argue that prolonged protectionism could cause sustained instability in global trade networks and might provoke retaliatory measures from China, complicating an already fragile global economic environment. Business groups continue to warn that while the aim of reviving American shipbuilding is laudable, the immediate impact on consumers and businesses could be costly.